Главная страница Случайная страница

КАТЕГОРИИ:

АвтомобилиАстрономияБиологияГеографияДом и садДругие языкиДругоеИнформатикаИсторияКультураЛитератураЛогикаМатематикаМедицинаМеталлургияМеханикаОбразованиеОхрана трудаПедагогикаПолитикаПравоПсихологияРелигияРиторикаСоциологияСпортСтроительствоТехнологияТуризмФизикаФилософияФинансыХимияЧерчениеЭкологияЭкономикаЭлектроника

Introduction. Higher School of Economics

|

|

Higher School of Economics

Международный институт экономики и финансов

Бакалаврская программа

«Экономика и финансы»

Diploma paper

On topic: «Implication of demographical structure on stock and bond prices».

Eldarkhanov Musa

Scientific supervisor: V.Bragin

Moscow 2016

Structure

Introduction ………………………………………………………………………

Chapter 1. The first researches on demography implications.

1.1. Economic rise in Western Europe and the U.S. after World War II

1.2. Economic growth and demography theoretical relationship.

1.3. Case study of population structure change and economic growth.

Chapter 2. Relationship between asset classes and demography.

2.1. Explanation of relationship between asset classes and age of individual and possible factors which may have an influence on asset returns.

2.2. Empirical researches of relation between stock/bond prices and demographic factors in developed countries.

Chapter 3. Long-term relationship between asset prices and demographic changes.

3.1. U.S.

3.2. Japan

3.3. U.K.

3.4. France

3.5. Germany

Conclusion……………………………………………………………………..

Literature……………………………………………………………………...

Introduction

After the World War II many countries experienced so-called «Baby Boom» which refers to a time period when birth rate were much higher than before and after the boom. There are many opinions when this phenomena started, but it is common to believe that approximately between 1946 and 1964. The people who were born during this period are often called «Baby boomers» and now, in 2016, these individuals are between 52 and 70. The term baby boomer associated with both cultural and technological phenomena. Culturally baby boomers are believed to be the generation of liberal values, freedom, civil rights movements. Technically, as written above, it is only the demographic term.

The interest of economic research in this phenomena is caused by relation between economic growth and demographical structure of a particular country. Financial researchers are interested in this generation as the demographical structure changes the behavioral trends on financial markets as people of different age consume, save, lend and borrow corresponding to the age group they refer to.

Economies of countries experienced baby boom after the World War II started taking so-called «demographical dividend» in the late 1960s in the U.S. and 1970s in Europe as baby boomers were joining the working-age population group and this changed the proportion of dependents in a population. This let countries perform an economic growth. However, now these people are entering the retiring age and smaller group of people have to pay social transfers to them.

Chapter 1The first researches on demography implication.

1.1 Economic rise after World War II.

Historical period between 1945 and early 1970s is called post-World War II expansion. Also, it is called the age of capitalism as it refers to capital accumulation in countries with capitalist economies, primarily in the U.S., countries of Western Europe and Japan.

Initially, countries heavily damaged by World War II could sustain economic growth by simply repairing that damage, rebuilding capital stock, reemploying men who were called to serve their country. After that, growth could be endured due to exploiting technological improvement made during the war.

As one of the most significant factor triggered rapid economic growth economists consider the outstanding growth of productivity of labor. It is believed that such rapid labor productivity growth happened due to a huge gap between current output and potential technological output after World War II.

Figure 1.Labor productivity gap after World War II.

Source: Summers and Heston (1991)

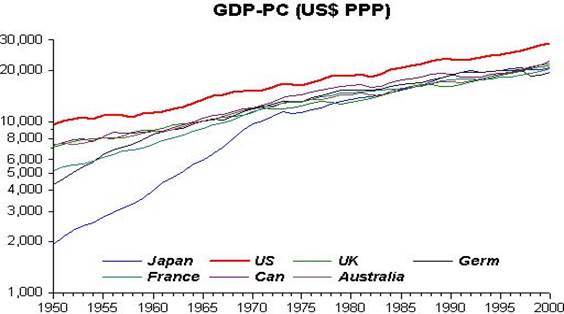

On figure 1 we can see the convergence of industrialized countries to the U.S. which was the most developed country in the world in every industry at that time. But this convergence may be mentioned not only about labor productivity, but also about GDP growth. This seems very consistent with neoclassical theory of club convergence as countries damaged by the wartime had low initial income and high growth rates of GDP while the U.S. did not experience significant damage and had lower growth rate of GDP. Figure 2 is a great illustration of this «catch-up».

Figure 2. GDP per capita 1950-2000.

It should be mentioned that post-war time is marked as time of financial repression. Financial repression refers to policy that keeps nominal interest rate lower than inflation rate. This allows to provide government and corporations with cheap loans lowering the burden of repayments. Financial repression policy helped the Western countries to lower debt-to-GDP ratio significantly after recent shocks associated with World War II and Great Depression (in the U.S.).

To fully understand the essence of so rapid growth, we should think of rise in the rate of profit which became possible due to outstanding world economic climate. It made possible the redistributions of welfare created by workers back to them, thus, rising the real wage and increasing the demand for products and expanding emerging industries.

However, economic development exhausted itself by the end of 1960s due to structural crisis which is often explained by fall in the rate of profit (Dumenil and Levy, 2000). It would be enough to show figure 3 which depicts downtrend of profit rate happened in six sectors of U.S. economy.

Figure 3. Trends of profit rate in six sectors of U.S. economy. [2]