Главная страница Случайная страница

КАТЕГОРИИ:

АвтомобилиАстрономияБиологияГеографияДом и садДругие языкиДругоеИнформатикаИсторияКультураЛитератураЛогикаМатематикаМедицинаМеталлургияМеханикаОбразованиеОхрана трудаПедагогикаПолитикаПравоПсихологияРелигияРиторикаСоциологияСпортСтроительствоТехнологияТуризмФизикаФилософияФинансыХимияЧерчениеЭкологияЭкономикаЭлектроника

Variable Cost

|

|

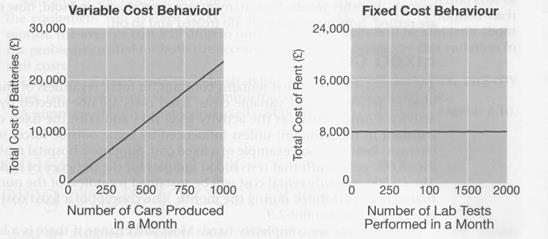

A variable cost is a cost that varies, in total, in direct proportion to changes in the level of activity. The activity can be expressed in many ways, such as units produced, units sold, miles driven, beds occupied, lines of print, hours worked, and so forth. A good example of a variable cost is direct materials. The cost of direct materials used during a period will vary, in total, in direct proportion to the number of units that are produced. To illustrate this idea, consider the example of a car factory. Each car requires one battery. As the output of cars increases and decreases, the number of batteries used will increase and decrease proportionately. If car production goes up 10 per cent, then the number of batteries used will also go up 10 per cent. The concept of a variable cost is shown in graphic form in Exhibit 2.

Variable and fixed cost behaviour

It is important to note that when we speak of a cost as being variable, we mean the total cost rises and falls as the activity level rises and falls. This idea is presented below, assuming that a battery costs £ 24:

| Number of cars produced | Cost per battery | Total variable cost-batteries |

| 1, 000 | £ 24 | £ 24 12, 000 24, 000 |

One interesting aspect of variable cost behaviour is that a variable cost is constant if expressed on a per unit basis. Observe from the tabulation above that the per unit cost of batteries remains constant at £ 24 even though the total amount of cost involved increases and decreases with activity.

There are many examples of costs that are variable with respect to the products and services provided by a company. In a manufacturing company, variable costs include items such as direct materials and some elements of manufacturing overhead such as lubricants, shipping costs and sales commissions. For the present we will also assume that direct labour is a variable cost, although as we shall see later, direct labour may act more like a fixed cost in many situations. In a merchandising company, variable costs include items such as cost of goods sold, commissions to salespersons and billing costs. In a hospital, the variable costs of providing health care services to patients would include the costs of the supplies, drugs, meals and, perhaps, nursing services.

The activity causing changes in a variable cost need not be how much output is produced or sold. For example, the wages paid to employees at a video outlet will depend on the number of hours the shop is open and not strictly on the number of videos rented. In this case, we would say that wage costs are variable with respect to the hours of operation. Nevertheless, when we say that a cost is variable, we ordinarily mean it is variable with respect to the volume of revenue-generating output - in other words, how many units are produced and sold, how many videos are rented, how many patients are treated and so on.